With Jerome Powell so data-dependent, as he stated on his second and last day of testimony, it seems pretty obvious where most of the growth and labor strength is coming from.

This isn’t the first time we have seen semiconductors lead the market, and we can say that it has not historically ended well if the rest of the Economic Modern Family cannot keep up.

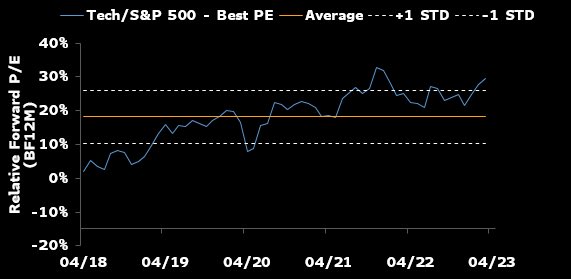

Tech’s relative premium compared to the S&P 500 is nearing its pandemic bubble peak. This is in an environment a bit different than late 2021, thought, as we now have much higher interest rates, and slower economic growth. And that is both the good news and bad news.

With AI and chip stocks so obviously outperforming the SPY and the rest of the Economic Modern Family, you have to wonder — is this a delusional response, or like Wonder Woman herself, impervious to the barbs of rates, GDP, geopolitics and sentiment?

Of all the sectors in the Modern Family, SMH is indeed the strongest. Our “Sister” SMH sits right below the 23-month or 2-year business cycle. Why is this significant?

In 2021 we saw a major bull market. In 2022, we had a major bear market. Is it any wonder that 2023 remains the “what’s up” year to date? Yet it is also the reason we are watching SMH so carefully.

If SMH fails to take out the 23-month and begins to decline from here, clearly the weakness of Regional Banks (KRE) and Retail (XRT) has come home to roost. Conversely, should SMH clear and close by month’s end the 23-month moving average, then it tells us 2 things.

The best hope for the US economy’s growth lies with chip technology.The rest of the Family may not run hot, but it will more than likely stop the bleed.

For more detailed trading information about our blended models, tools and trader education courses, contact Rob Quinn, our Chief Strategy Consultant, to learn more.

IT’S NOT TOO LATE! Click here if you’d like a complimentary copy of Mish’s 2023 Market Outlook E-Book in your inbox.

“I grew my money tree and so can you!” – Mish Schneider

Get your copy of Plant Your Money Tree: A Guide to Growing Your Wealth and a special bonus here.

Follow Mish on Twitter @marketminute for stock picks and more. Follow Mish on Instagram (mishschneider) for daily morning videos. To see updated media clips, click here.

Mish in the Media

Mish joins Mary Ellen McGonagle (of MEM Investment Research) and Erin Swenlin (of DecisionPoint.com) on the March 2023 edition of StockCharts TV’s The Pitch.

Mish talks women in finance for International Women’s Day on Business First AM.

Mish focuses on defense stocks in this appearance on CNBC Asia.

Mish points out a Biotech stock and a Transportation stock to watch if the market settles on Business First AM.

Mish joins Maggie Lake on Real Vision to talk commodities and setups!

Read about Mish’s article about the implications of elevated sugar prices in this article from Kitco!

While the indices remain range bound, Mish shows you several emerging trends on the Wednesday, March 1 edition of StockCharts TV’s Your Daily Five!

Mish joins Business First AM for Stock Picking Time in this video!

See Mish sit down with Amber Kanwar of BNN Bloomberg to discuss the current market conditions and some picks.

Click here to watch Mish and StockCharts.com’s David Keller join Jared Blikre as they discuss trading, advice to new investors, crypto, and AI on Yahoo Finance.

In her latest video for CMC Markets, MarketGauge’s Mish Schneider shares insights on the gold, the S&P 500 and natural gas and what traders can expect as the markets remain mixed.

Coming Up:

March 8th: Investment Strategy Twitter Spaces with Wolf Financial

March 9th: Twitter Spaces with Wolf Financial

March 13th: Mish on TD Ameritrade with Nicole Petallides

March 14th: F.A.C.E. Forex Analytix with Dale Pinkert

March 16th: The Final Bar with Dave Keller, StockCharts TV

And down on the road

March 20th: Madam Trader Podcast with Ashley Kyle Miller

March 22nd: The RoShowPod with Rosanna Prestia

March 24th: Opening Bell with BNN Bloomberg

March 30th: Your Daily Five, StockCharts TV

March 31st: Festival of Learning Real Vision “Portfolio Doctor”

April 24-26: Mish at The Money Show in Las Vegas

ETF Summary

S&P 500 (SPY): 390 support with 405 pivotal, 410 resistance.Russell 2000 (IWM): 190 resistance, 185 support.Dow (DIA): 326 support, 335 resistance.Nasdaq (QQQ): 300 the pivotal area, 290 major support; 284 big support, 300 pivotal, 305 resistance.Regional Banks (KRE): 57 big support, 60 resistance.Semiconductors (SMH): 240 pivotal, 248 key resistance; 248 resistance, 237 then 229 support.Transportation (IYT): 240 resistance and 230 support.Biotechnology (IBB): 125-135 trading range.Retail (XRT): 66 pivotal with 64 key support.

Mish Schneider

MarketGauge.com

Director of Trading Research and Education