US President Donald Trump praised Liberian President Joseph Boakai for his strong grasp of the English language on Wednesday. But the African leader was educated in Liberia, where English is the official language.

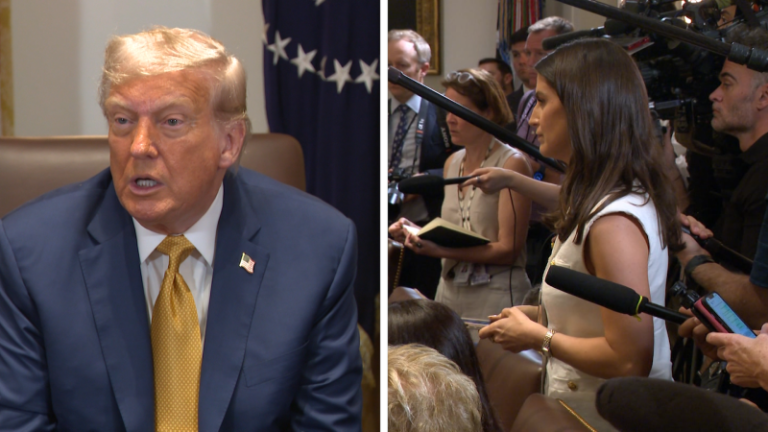

As he hosted five African leaders at the White House, Trump asked Boakai: “Such good English, it’s beautiful. Where did you learn to speak so beautifully?”

Boakai informed Trump of his place of education, prompting Trump to express his curiosity. “That’s very interesting,” he said, “I have people at this table who can’t speak nearly as well.”

Liberia was founded in 1822 by the American Colonization Society whose goal was to resettle freed slaves in Africa. The country declared independence from the American Colonization Society in 1847, and a variety of languages are spoken in the country today, with English being the official language.

Several Liberians voiced their offense over Trump’s comment to Boakai, given the US president’s past remarks on African countries and the colonial legacy left by the US organization in Liberia.

“For him to ask that question, I don’t see it as a compliment. I feel that the US president and people in the west still see Africans as people in villages who are not educated.”

Veronica Mente, a South African politician, questioned on X: “what stops [Boakai] from standing up and leav[ing]?”

The White House Press Office defended Trump’s statement on Wednesday.

White House deputy press secretary Anna Kelly said that Trump’s comment was a “heartfelt compliment” and that “reporters should recognize that President Trump has already done more to restore global stability and uplift countries in Africa and around the world than Joe Biden did in four years.”

“What President Trump heard distinctly was the American influence on our English in Liberia, and the Liberian president is not offended by that,” Nyanti said.

“We know that English has different accents and forms, and so him picking up the distinct intonation that has its roots in American English for us was just recognizing a familiar English version,” she continued.

Trump has previously applauded the English language abilities of other leaders during diplomatic meetings. During a press conference with German Chancellor Friedrich Merz, Trump complimented his “good English” and asked if it was as good as his German.

Merz laughed and noted that he tries to “understand almost everything” and said he makes an effort “to speak as good as I can.”

The US president has centered the English language as part of this “America First” platform. During a 2015 presidential debate, Trump asserted that the US is “a country where we speak English.” In March, he signed an executive order making English the official language of the US.

Trump has previously landed in hot water for things he has said about the African nations. In 2018, the president referred to migrants from African countries and other nations as coming from “shithole countries.”

In May, he lectured South African President Cyril Ramaphosa on false claims that White South African farmers are the victims of a genocide.

Trump struck a different tone on Wednesday as he met with the leaders of Gabon, Guinea-Bissau, Liberia, Mauritania, and Senegal, praising their countries as “all very vibrant places with very valuable land, great minerals, great oil deposits, and wonderful people.”

In turn, he was met with approval from the African leaders, who heaped praise on the president as they urged him to invest in their countries and develop their plentiful natural resources.

Boakai even remarked that Liberia “(believes) in the policy of making America great again.”